Form Entry Tax Software For Mac

If you've been rooting around the Mac App Store for an app that'll help you prepare and file your tax return, you've likely come up empty-handed — there aren't any on Apple's Mac app store.

- Tax Software For Form 1041

- Form Entry Tax Software For Mac Download

- Legal Forms Software For Mac

- Form Entry Tax Software For Mac Pro

That said, you don't actually need an app: There are plenty of great web-based services to help you get your taxes done on time and, hopefully, audit-free.

Tax Software For Form 1041

Sep 09, 2019 Top Best Tax Software for All Macs MacBook Pro, MBA, iMac, MacMini 1: TaxSlayer. TaxSlayer is pretty simple to use. Depending on your requirement you can select any model such as classic, premium or self-employed. And if you want for paying simple tax such as state tax or federal tax or 1040EZ form, then it is available for free.

Note: We will note that arguably, you shouldn't need specialized tax software or companies to prepare your taxes — the U.S. government has entertained several proposals throughout the years to simplify its tax code, but lobbyists from the top tax prep companies have spent millions of dollars to squash those plans to save their own bottom line. This isn't necessarily an argument against using these services — many of iMore's U.S. writers still use them. But it's worth being informed.

May 24, 2019 In the TurboTax CD/Download software, you can override (replace) a calculated figure in Forms Mode.This feature is unavailable in TurboTax Online. Important: Under normal circumstances, you shouldn't have to override anything.Returns that contain overrides cannot be e-filed and may not be covered under our 100% Accurate Calculation Guarantee.We're providing these instructions to. TaxWise utilizes both the interview mode and form-entry mode to request tax information from clients. Both modes appeal to new tax preparers because it provides them with guidance. It includes a variety of corporate forms that allows TaxWise users to handle both business and 1040 tax.

TurboTax Online Edition

TurboTax is often the top name you might recognize when it comes to self-filing, largely because Intuit's online software is simple and quick to use. TurboTax breaks down the whole process to make filling straightforward and simple, and it makes sure you're giving the IRS all the necessary information and in turn maximizing your return.

You can file your federal taxes for free and file state taxes for free if you're filling a 1040EZ or 1040A. If you're someone who makes under $100,000 and you don't own a home, this is the way you will file. Otherwise, it costs about $30 per state to file with TurboTax. If you need more help, this site also offers Deluxe, Premier, Self-Employed, and TurboTax Live versions for higher price points.

TaxAct

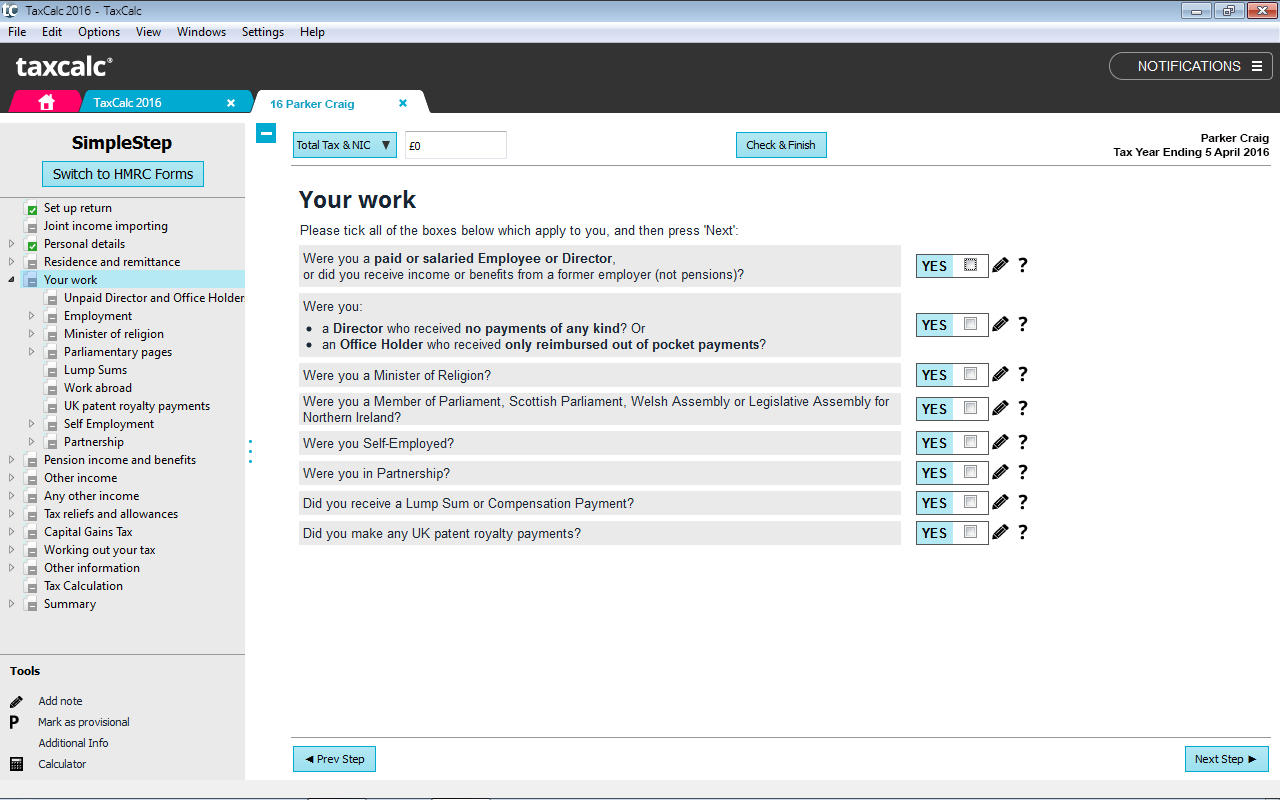

TaxAct is another online service in the same vein as TurboTax. It's a simple, step-by-step guide that will walk you through all the necessary questions and paperwork to make sure you get the most out of your return. These kinds of filling sites are quick and easy to follow, not to mention quite a bit cheaper then TurboTax.

You have three options for filing: Free, Basic+ for $15, Deluxe+ for $50, Premier+ for $60, and Self Employed+ for $80 as well as an additional $20-$40 for each state. You'll get free phone support with each package, so if you prepare your return and get stuck, you can call up a TaxAct rep to guide you through the process. TaxAct also has a 'Price Lock' guarantee, so you'll pay the price listed at the time you create your return, even if you decide to file months later.

H&R Block

Like TurboTax, H&R Block's online filing service breaks everything down from the very start. When you arrive on the site, you'll be able to choose the options that best describe your situation to get the preparation process that fits you the best without frivolous details or questions in the mix. You can file online and even have a tax professional take a look at your return beforehand to make sure everything's in order and you've maximized your return.

You can choose their Free version, Deluxe version for $33, Premium for $46, or the Self-Employed version for $68, based on which one best fits your lifestyle. Free is great for the simplest tax returns, and going up to Premium is for rental property owners or contractors. All of these options are started for free and paid out by the end of the return, whether it's out of pocket or out of the return.

Credit Karma

Form Entry Tax Software For Mac Download

Credit Karma is heard every where, be it TV or radio, but not typically for taxes. The company doesn't just offer a free way for you to check your credit score, you can also prepare and file your tax return on its website. Currently you can file both your federal and state taxes for free — with no hidden fees — though Credit Karma offers significantly more complicated step-by-step instructions than a service like TurboTax.

Even though it's not as simple as H&R Block or TurboTax, going more in-depth with your refund isn't necessarily a bad thing. Credit Karma guarantees to get you the most out of your refund, and it's easy to see that with all the information they get out of your paperwork. If you're not sure Credit Karma is right for you, you can even make sure that it supports all the forms that are relevant to your tax return.

TaxSlayer

Legal Forms Software For Mac

TaxSlayer offers several tax packages designed to help you prepare and file your federal and state tax returns and get the tax deductions to which you are entitled. Each version of TaxSlayer, Classic, Premium, Military, SimplyFree, and Self-Employed, let you prepare, print, and e-file your taxes, offer an accuracy guarantee, and let you upload last year's tax return.

Except for the SimplyFree version, TaxSlayer also focuses on getting you your deductions. For $17, TaxSlayer Classic also offers support for every type of tax form and IRS inquired assistance. The $37 Premium package offers IRS audit assistance, support from tax professional and priority support. The TaxSlayer Military offers the features of Classic for free to members of the military. All of TaxSlayer's plan pricing is for your federal return, while adding your state return will cost an additional $29 on top of the rest of these plans.

IRS Free File

If you don't trust online tax prep services or you just want to go straight to Uncle Sam, check out the IRS's Free File service. It's free-to-download software that helps you prepare and e-file your return, and it's available Free in two versions: one for people with an income of less than $66,000/year and the other for those with an income greater than $66,000.

The IRS service is very DIY so make sure you know a bit about self-filing your taxes. If you make under $66,000, you have software to file both federal and state taxes for free. However, if you make more than $66,000, you'll have to print the forms for federal taxes and manually mail them in since there's no software option. The IRS does not have state forms for you to mail in, so use Free File's lookup tool to find out where you can get them, or it can help you find free federal and state filing options if you're not interested in filling out the form directly.

What to know if you owe

Hopefully you'll be receiving a big refund from your completed taxes but for those of you who end up owing the IRS, there are several payment methods available. Most people will pay their tax liability by direct withdrawal from their bank account or with a physical check. You also have the option to pay using a credit or debit card but you'll have to go through a 3rd party service and pay fees upwards of 1.99% on credit cards and a flat fee of up to $4 on debit cards. Except for a few fringe cases, those added fees basically wipe out any points or miles benefits when paying with a credit card. If you're unsure which payment method to use, we'd recommend reaching out to a tax professional for assistance.

How do you file on your Mac?

Do you file your own taxes using your Mac? Which service do you use? Tell us in the comments below and let us know why you like it.

Updated April 2019: Added TaxSlayer and updated pricing for the 2019 tax season.

We may earn a commission for purchases using our links. Learn more.

exposure notificationNational COVID-19 server to use Apple and Google's API, hosted by Microsoft

The Association of Public Health Laboratories has announced it is working with Apple, Google, and Microsoft to launch a national server that will securely store COVID-19 exposure notification data.

Preview User Guide

Some PDFs are forms you can fill out and then print or send. If a form requires a signature, you can add your signature to any PDF.

Fill out a PDF form

In the Preview app on your Mac, open the PDF form.

Click a field in the form, then type your text.

If you save the form (by choosing File > Export), you can close it, open it later, and continue to fill it out.

Create and use signatures

To sign PDFs, you can capture your signature using your trackpad, the built-in camera on your Mac, or iPhone or iPad.

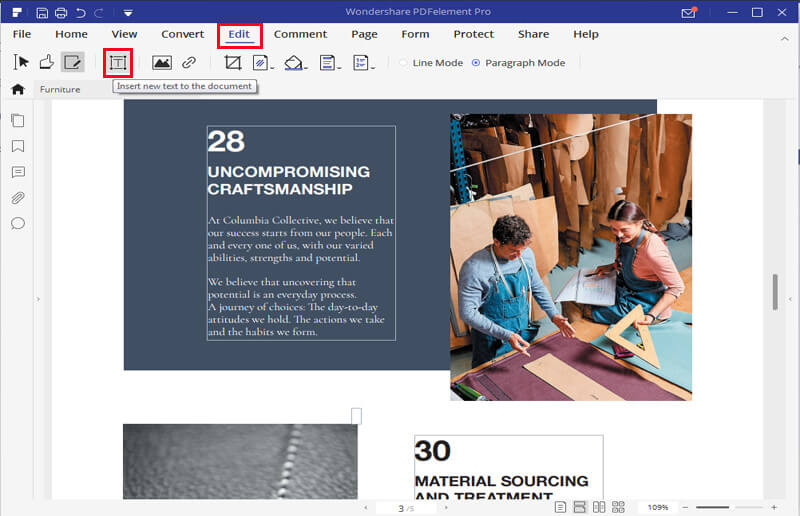

In the Preview app on your Mac, if the Markup toolbar isn’t showing, click the Show Markup Toolbar button , then click the Sign button .

Follow the onscreen instructions to create and save your signature.

Create a signature using your trackpad: Click Trackpad, click the text as prompted, sign your name on the trackpad using your finger, press any key, then click Done. If you don’t like the results, click Clear, then try again.

If your Mac has a Force Touch trackpad, you can press your finger more firmly on the trackpad to sign with a heavier, darker line.

Create a signature using your computer’s built-in camera: Click Camera. Hold your signature (on white paper) facing the camera so that your signature is level with the blue line in the window. When your signature appears in the window, click Done. If you don’t like the results, click Clear, then try again.

Create a signature using your iPhone or iPad: Click iPhone or iPad. On your iPhone or iPad, sign your name using your finger or Apple Pencil. When your signature appears in the window, click Done. If you don’t like the results, click Clear, then try again.

Add the signature to your PDF.

Choose the signature you want to use, drag it to where you want it, then use the handles to adjust the size.

If you use iCloud Drive, your signatures are available on your other Mac computers that have iCloud Drive turned on.

Delete a saved signature

Form Entry Tax Software For Mac Pro

In the Preview app on your Mac, if the Markup toolbar isn’t showing, click the Show Markup Toolbar button .

Click the Sign button , then click the X to the right of the signature you want to delete.